Nordea Taps Meniga’s Cashback Rewards Platform for Its Swedish Customers

by Fintechnews Nordics June 11, 2021Icelandic digital banking and finance solutions developer Meniga has signed a new partnership agreement with Nordea, a financial services groups in the Nordics, to continue the integration of its cashback rewards platform within the latter’s mobile banking app in Sweden.

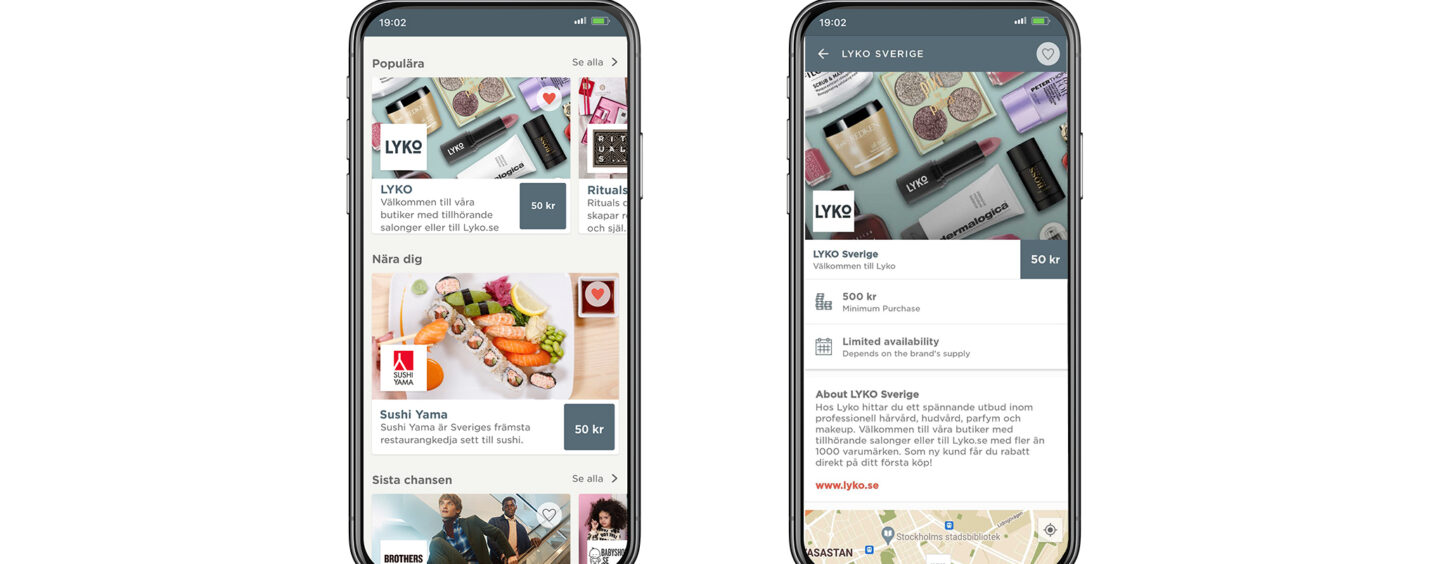

According to the agreement, Nordea will continue to offer personalised cashback rewards, which are tailored to individual spending profiles, to its customers in Sweden.

Through the multi-bank platform, banks can seamlessly integrate, via Meniga’s cloud-based API, cashback rewards directly into their mobile banking applications, and provide their customers with various personalised, cashback rewards and discounts from retail brands.

The platform offers merchants a way of attracting new customers and a more cost-efficient marketing tool.

Fundamentally, this helps create a mutually beneficial ecosystem between banks, merchants and consumers.

Meniga’s cashback rewards platform has already been used by 650,000 end-users across Sweden, Finland and Iceland.

Nordea is one of three Nordic financial institutions currently live on Meniga’s cashback rewards platform, connecting to over 250 retail partners.

Georg Ludviksson

Georg Ludviksson, CEO and Co-Founder of Meniga said,

“We’re delighted to have renewed our contract with Nordea Sweden. At a time when neo-banks and fintechs alike are increasingly launching their own cashback rewards platforms, it has never been more important for banks to follow suit if they wish to stay relevant and compete in this new financial landscape.

Our rewards service presents a perfect illustration of how financial institutions can take advantage of the opportunities provided by open banking, in order to open up their digital channels, extract value from their users’ financial data and create a mutually beneficial ecosystem with their customers and other industry or non-industry players.”

This article first appeared on Fintech News Baltic

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.