In February 2021, the second phase of the e-krona pilot project began. The aim of the work was to continue investigating and testing the technical solution developed in the project and also to investigate a potential legal framework around the e-krona.

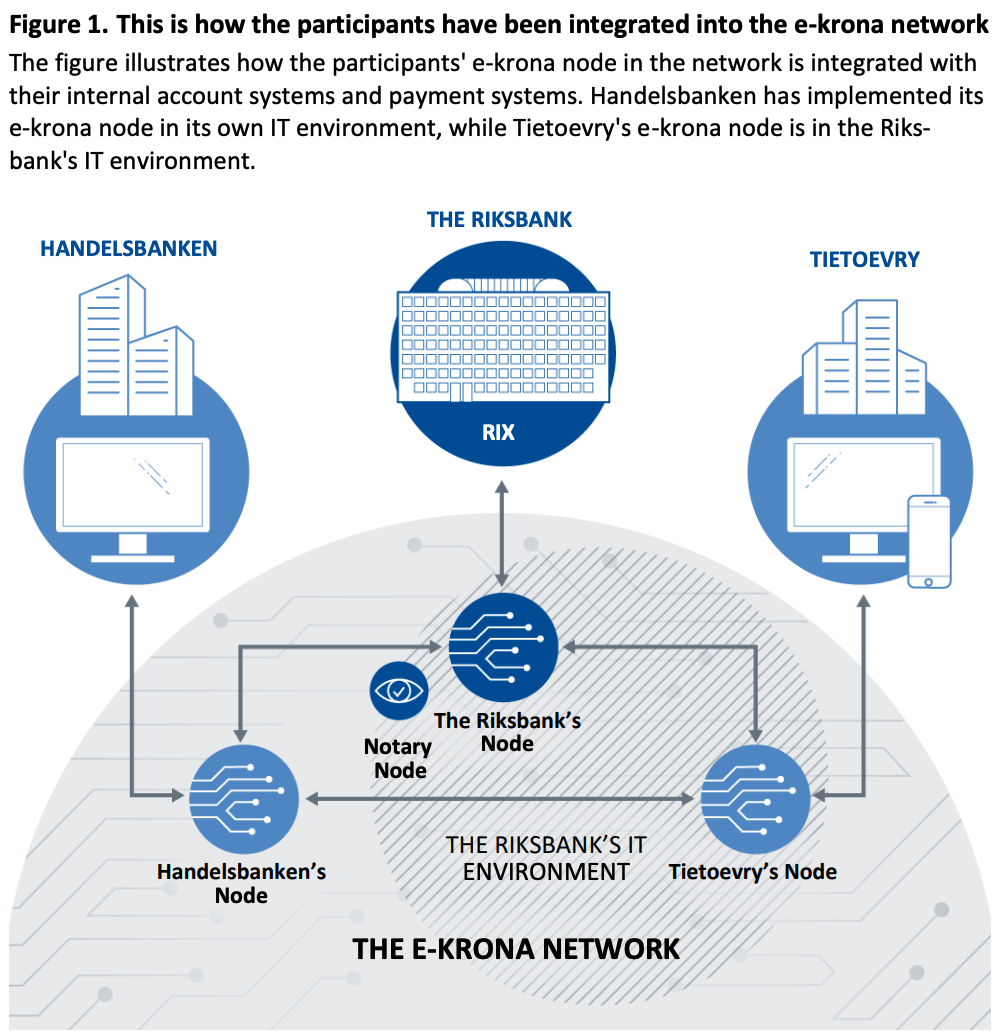

During Phase 2, the technical tests have included investigating whether and how an e-krona might function off-line, whether the performance of the tested solution is adequate, and how banks and other payment service providers could be integrated into an e-krona network. The latter has been tested in collaboration with Handelsbanken and Tietoevry.

This is how the participants have been integrated into the e-krona network, E-krona report: E-krona Pilot Phase 2

The tests have shown, for instance, that it is possible to integrate a potential e-krona into the internal systems the banks have today, and this would make it possible for their customers to exchange money in their bank account for e-kronor, and vice versa. The tests of the technical solution have also shown that it would be possible to make transactions using e-krona, even off-line. However, off-line payments would entail some risks that need to be managed if a similar solution is to become a reality.

The project has also investigated the legal questions surrounding a potential e-krona. For instance, it has examined what type of asset an e-krona would be. The conclusion is that it could be regarded as an electronic form of cash.

The e-krona pilot project aims to increase the Riksbank’s knowledge of how an e-krona could be designed and how it would function. No decision has yet been taken on whether to issue an e-krona or on what technical solution or legal framework it might be based. The work is now entering into Phase 3, which will investigate the requirements made of a future e-krona, among other issues.

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.