Swedish Fintech Startups Face Funding Challenges, Regulatory Hurdles

by Fintechnews Nordics March 4, 20242023 was a tough year for the Swedish fintech industry as companies continued to face a challenging fundraising landscape, fueling a slowdown in new recruitments, and as regulatory requirements persisted in burdening fintech operations, a new report by the Swedish Fintech Association (SweFintech) says. For Sweden to remain competitive in the face of rising fintech hubs including Lithuania and Estonia, several measures must be put in place to encourage innovation and support the growth of young ventures.

The 2024 edition of the Fintech Report, released earlier this year, gives an up-to-date picture of the Swedish fintech industry, describing how the industry developed in 2023 and addressing the various challenges Swedish fintech companies are facing. It draws on a survey conducted among SweFintech’s member companies in the autumn of 2023, and proposes measures that decision-makers and authorities can take to promote the continued growth of the Swedish fintech industry.

Funding and regulatory challenges

According to the report, 2023 was a challenging year for the Nordic fintech industry, which endured a trying macroeconomic environment. Data from Fintech Global show that the number of fintech investments in the region dropped by a staggering 77% year-over-year (YoY) in Q3 2023, and that the total capital invested plummeted by a full 97%.

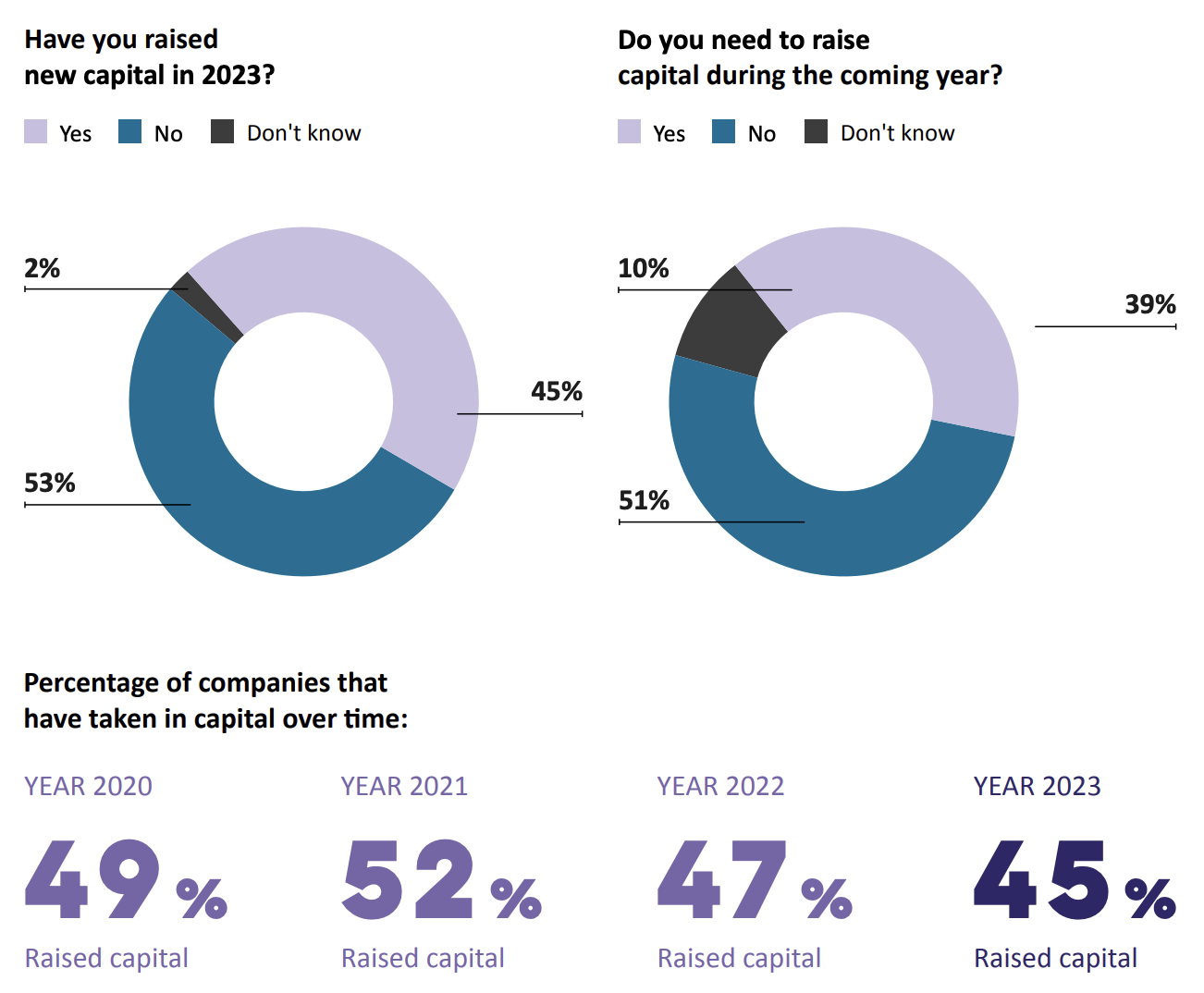

The 2023 SweFintech survey revealed a similar picture, with 59% of the fintech companies polled last year indicating that it had become even more difficult to raise capital over 2023, an increase from 56% in 2022. However, the proportion of fintech companies actually managing to secure capital remained relatively stable, standing at 45% in 2023 compared to 47% in 2022 and 52% in 2021.

Moreover, only 6% of the companies surveyed said that they had to pause a funding round, compared to 11% the previous year. This trend may indicate that companies were more cautious about seeking capital in the current climate and plummeting valuations, the report says.

Capital raising in 2023, Source: 2024 Fintech Report, Swedish Fintech Association, 2024

Besides funding challenges, Swedish fintech companies also reported continued pressure from regulatory bodies. In 2023, 76% of the companies said that they found regulations to be burdensome, a figure that’s similar to previous years.

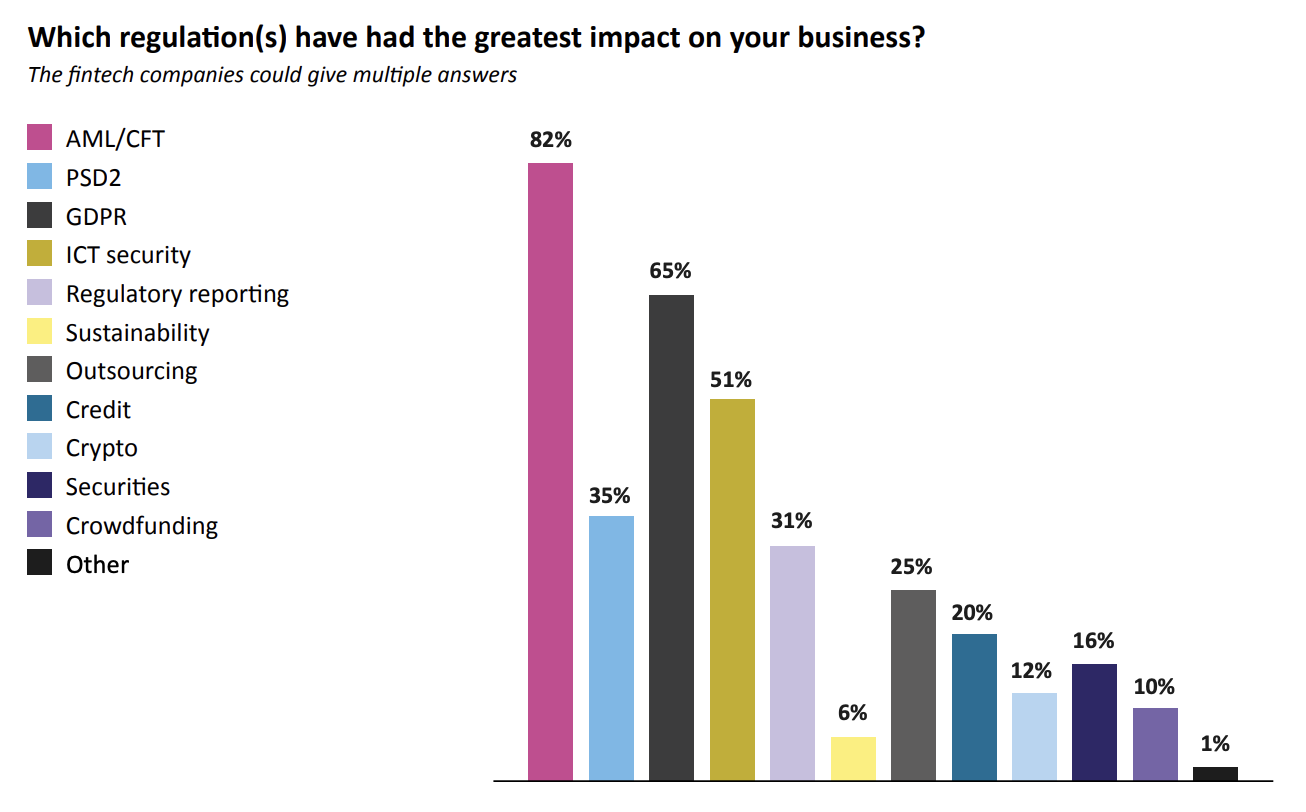

Respondents named regulations concerning anti-money laundering and combating the financing of terrorism (AML/CTF) as the rules with the biggest impact on their businesses (82%), followed by the European Union (EU)’s General Data Protection Regulation (GDPR) (65%), and legislation related to information and communications technology security (ICT) (51%).

Which regulations have had the greatest impact on your business? Source: 2024 Fintech Report, Swedish Fintech Association, 2024

Decreasing recruitment rates

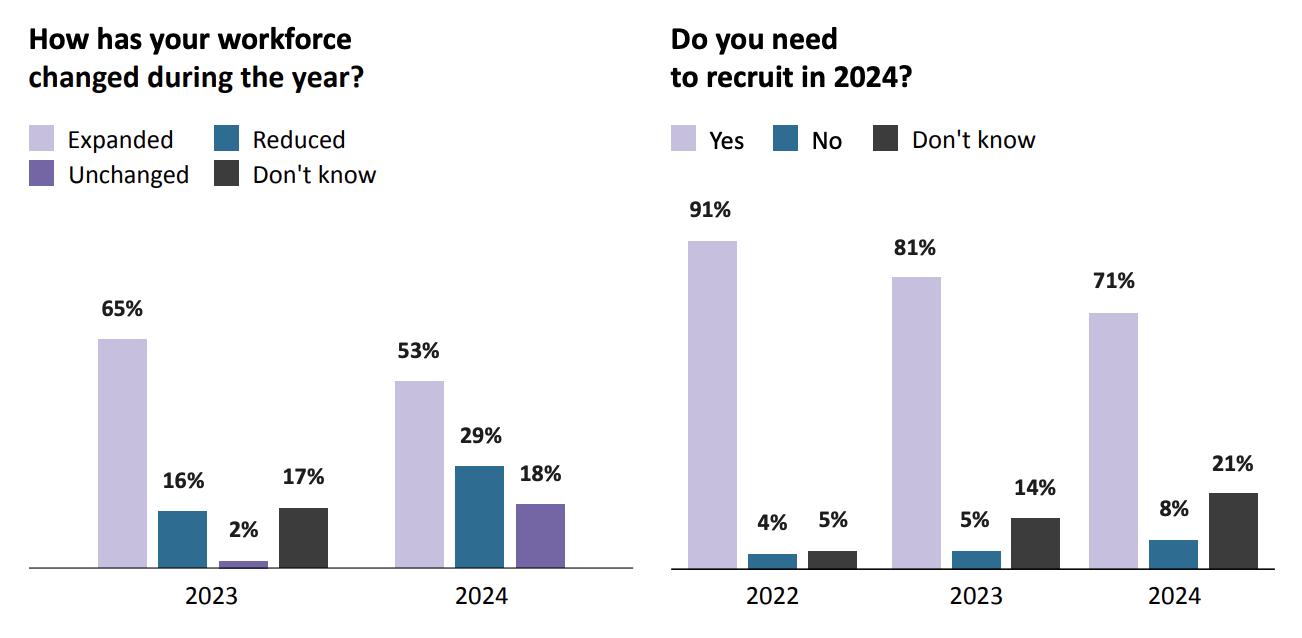

The study also found that this challenging environment is forcing fintech companies to pull the brakes on recruitments as a way to cut costs and transition to profitability. Just over half of the companies polled last year expanded their workforce in 2023, a decrease from 65% in 2022. At the same time, nearly a third reported that they reduced staff numbers in 2023, almost double the figure in the previous year of 16%.

Last year, four out of five companies estimated that they would need to expand their workforce in 2023, but just over half of the companies actually recruited new personnel, revealing the difficulty of estimating recruitment needs in tougher times. Increased uncertainty about the future is also evidenced in the percentage of companies needing to recruit in the coming year, with 71% of the companies polled in 2023 stating that this is necessary, a decrease of 10% points from 2023.

That being said, the study found that this environment is making talent more accessible for fintech businesses. With more companies laying off personnel, Swedish fintech companies reported that it is now easier to recruit relevant talent (45%), a situation which can be in part explained by the increased availability of talent as well as by the fact that the competition for it is not as fierce as it used to be.

Workforce changes among Swedish fintech companies, Source: 2024 Fintech Report, Swedish Fintech Association, 2024

Adapting to challenging times

Findings also reveal that Swedish companies are adapting their businesses to more challenging times. For example, 39% of the companies polled believe they need to obtain new capital in 2024, compared to 47% in last year’s report. This could indicate that the companies have extended their runway through cost-saving measures and have shifted their focus from growth to profitability.

Among those still in need of capital, the survival time varies. One in five companies said that they can only survive for up to a year without additional capital, revealing a challenging market situation. At the same time, just under a third of the companies stated that they can survive for more than three years even if they are not yet profitable.

Less than half of the Swedish companies polled in 2023 indicated being profitable, and many factors are impacting their ability to become sustainable, including access to capital, viable business models, access to relevant skills, financial support from the government, economic conditions and consumer patterns, the report says.

Heightened competition from neighboring countries

The report notes that unless Sweden put in the work to establish a conducive environment for fintech companies to grow and thrive, the country is at risk of falling behind European counterparts.

It highlights that although Sweden has historically been recognized for its robust tech sector and prominent presence in fintech, with successful companies like Klarna and Zettle, the country’s tech and fintech competitiveness relative to the rest of Europe is diminishing.

Reports from TechSverige emphasize Sweden’s comparatively low growth in the tech sector from 2015 to 2020, positioning it near the bottom among European countries. At the same time, neighboring countries including some of the Baltics and the Netherlands are rapidly emerging as prominent tech hubs, thanks to supportive measures designed to promote innovation and support young ventures.

To address these challenges, SweFintech proposes a number of initiatives to encourage the growth of the fintech industry and create a more supportive environment for innovation and competition. These initiatives include increasing the accessibility of banking services for fintech companies, the introduction of new regulatory guidelines for innovative companies and increasing funding for research and innovation. Several previous proposals are still relevant, including the establishment of an open finance regulation that would cover a broader spectrum of financial services, the implementation of the EU’s proposal on Instant Payments, and the introduction of a regulatory sandbox to promote innovation in the financial market.

Sweden is home to more than 500 fintech companies, including some of Europe’s fastest-growing and highest-valued companies such as Sweden’s Klarna and Tink. The number gives Sweden a 42% market share in the Nordics’ fintech startup ecosystem of 1,200+ fintech startups, ahead of Denmark (319), Finland (210), Norway (180) and Iceland, making it the region’s leader in fintech growth and innovation.

Featured image credit: Edited from freepik

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.