Proptech Ecosystem in Sweden: Digital Wave Sweeps Across Sweden’s Real Estate Industry

by Fintechnews Nordics April 5, 2024In Sweden, the digital revolution in the real estate industry is in full swing, driven by a rapidly expanding ecosystem of proptech players that now counts nearly 150 companies, a new report by Planima, a local tech provider serving the real estate industry, says.

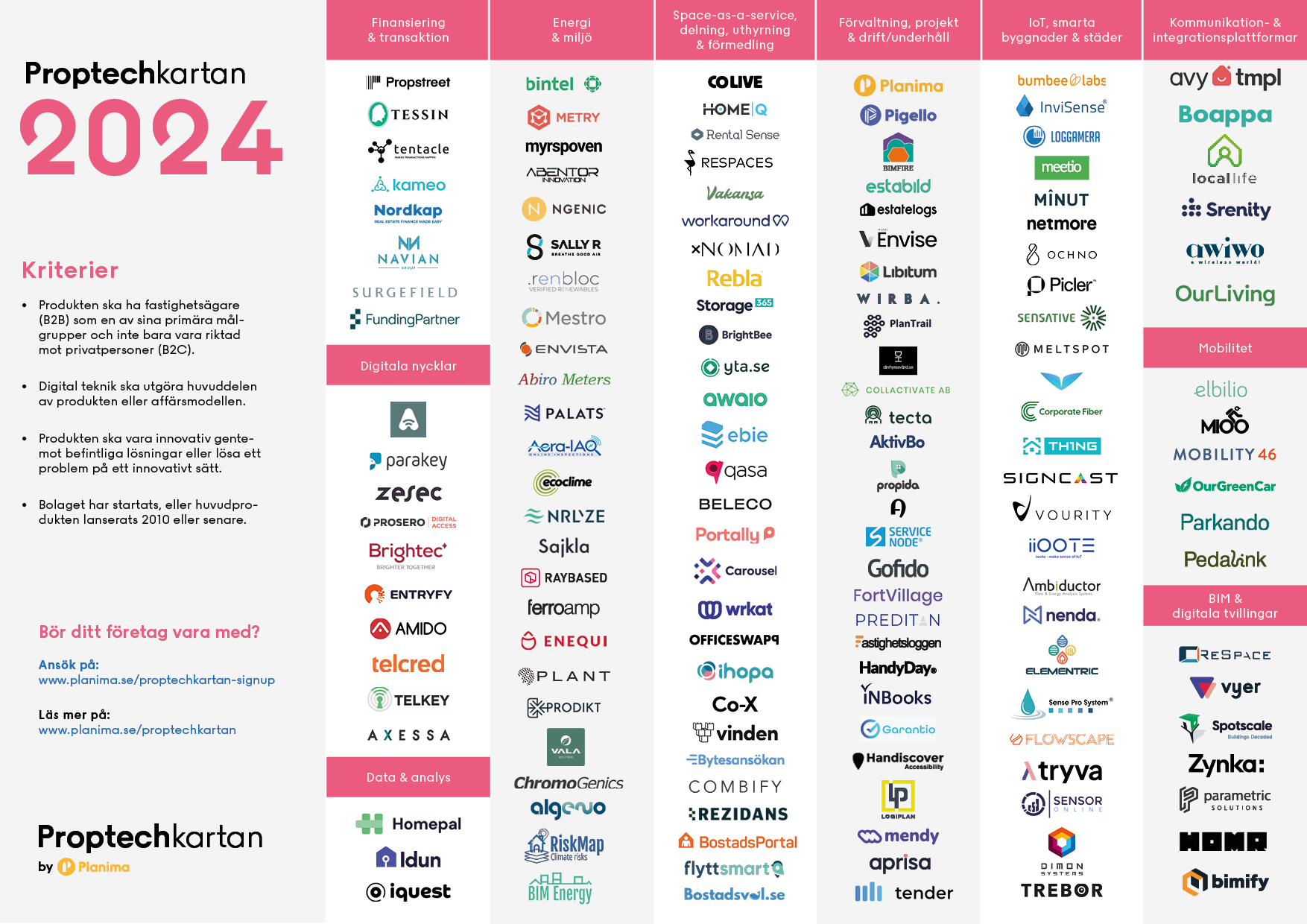

The report, released on March 20, 2024, looks at the Swedish proptech sector, exploring the 146 companies comprising the space.

According to the report, Sweden is home to a wide proptech ecosystem of startups offering diverse technologically innovative products and new business models for the real estate market.

Many of these startups provide solutions that allow industry stakeholders to gain in efficiencies and save costs, helping them automate repetitive tasks, predict trends and optimize investments, or manage their property more efficiently.

Other companies are developing solutions to improve customer experiences, offering web-based tools and digital contracts that allow for faster service delivery and increased customer satisfaction.

Finally, some focus on providing industry participants with competitive advantages, providing property owners and management companies with tools that allow them to turn potential challenges such as changing market conditions, new customer needs or economic fluctuations, into competitive advantages over slower players.

The Planima report divides Swedish proptech companies into ten verticals. Across these segments, Space-as-a-service, Sharing, Rental and Brokerage, and Administration, Projects and Operation/Maintenance are the two most crowded and developed vertical, featuring 28 players each.

Notable players in these categories include BostadsPortal, one of the largest marketplaces for vacant rental properties in Sweden; xNomad, a platform that connects brands and e-commerce stores to popup spaces, providing flexible short-term retail space solutions for business of all sizes; and Navian, a platform that digitize the real estate development and investment process.

Other notable verticals are the Internet-of-Things (IoT) and Smart Buildings/Cities (25 companies), Access-as-a-Service and Digital Keys (10), and Financing and Transactions (8).

Noteworthy startups in these categories include Accessy, an open system for digital keys that can be integrated with existing compatible locking systems; Kameo, an investment platform facilitating direct investments in property project loans across Scandinavia; and Flowscape, a provider of digital workplace and analytics solutions.

Proptech Ecosystem in Sweden

Sweden proptech startup map 2024, Source: Planima, Mar 2024

The Nordics’ proptech hub

In the Nordics, Sweden has emerged into a leading proptech hub with its capital city of Stockholm becoming a central hub for proptech innovation. According to a 2022 report by the official business and destination development agency for the City of Stockholm, several pivotal factors have contributed to the growth of proptech in the city.

Firstly, Stockholm is home to a dynamic ecosystem teeming with startups and innovation, rendering it an alluring destination for entrepreneurs venturing into the proptech sector. This vibrant atmosphere is underscored by the city’s track record of birthing successful tech enterprises like buy now, pay later (BNPL) giant Klarna and leading audio streaming and media service provider Spotify, indicative of a robust groundwork for fresh endeavors.

Secondly, Stockholm offers access to resources crucial for proptech growth. These range from top-tier infrastructure to relevant educational institutions, mentorship programs, innovation hubs, and accelerators, offering an environment that’s conducive to the swift evolution and expansion of proptech enterprises.

Thirdly, Stockholm presents a burgeoning landscape of investment prospects within the proptech domain. With an increasing number of venture capital (VC) firms and business angels demonstrating interest in proptech ventures, the city provides startups with enhanced opportunities to flourish and scale their businesses.

Swedish proptech startups secured a record of US$741 million in private equity investments in 2021, up 35% year-over-year (YoY), data from the report show. Growing investor confidence in the sector saw the average deal size of private equity investments in proptech reach a record of US$25 million that year.

Proptech investments growing strong

Proptech investments continued to rise in 2023, reaching a new high of US$13.4 billion raised globally, data from KPMG’s Pulse of Fintech H2 2023 show. The sum represents a 227% increase from US$4.1 billion in 2022 and makes proptech one of the only two fintech verticals that recorded YoY growth in 2023.

Last year, a combination of challenges, including high interest rates, geopolitical conflicts in Ukraine and the Middle East, and concerns about valuations, saw fintech investors becoming more cautious with their investments. A total of US$113.7 billion was raised by fintech companies through 4,547 deals in 2023, the sector’s weakest results since 2017.

Featured image credit: Edited from freepik