In Sweden, fintech companies are finding it more difficult to secure funding, noting that investors have adopted a more cautious approach amid economic uncertainties, geopolitical turmoil and soaring inflation. But despite the challenging venture funding landscape, fintech entrepreneurs remain confident in the sector’s prospects and are expecting growth in the year to come, a new report by industry trade group, the Swedish Fintech Association (SweFintech), says.

The report, titled the 2023 Fintech Report: From Growth to Profitability, provides an overview of the Swedish fintech industry, describing how the industry developed in 2022 and exploring the various challenges encountered by Swedish fintech companies.

In particular, the report discusses the changing conditions for the fintech industry in Sweden, noting that while 2021 was a record year for the sector with abundant capital and a focus on growth, there is now an increasing demand for profitability.

A 2022 survey that polled 57 fintech companies as part of the report revealed that fintech firms found it more challenging to raise capital in 2022 than prior years, noting that investors had become more cautious.

Of the 57 companies polled, only 47% said that they managed to raise venture capital (VC) in 2022, down 5% points from 2021’s 52%. 56% of respondents noted increased cautiousness among investors in 2022.

The challenging economic landscape is also visible in the recruitment trends and needs of Swedish fintech companies where 16% of respondents indicated that they had to downsize their workforce in the pursuit of better financial performances and improved profitability.

In 2022, 91% of respondents intended to expand their teams, the study found. However, only 65% of respondents effectively did so last year.

Swedish fintech companies’ recruitment needs throughout the years, Source: 2023 Fintech Report: From Growth to Profitability, Swedish Fintech Association, 2023

Regulatory burden

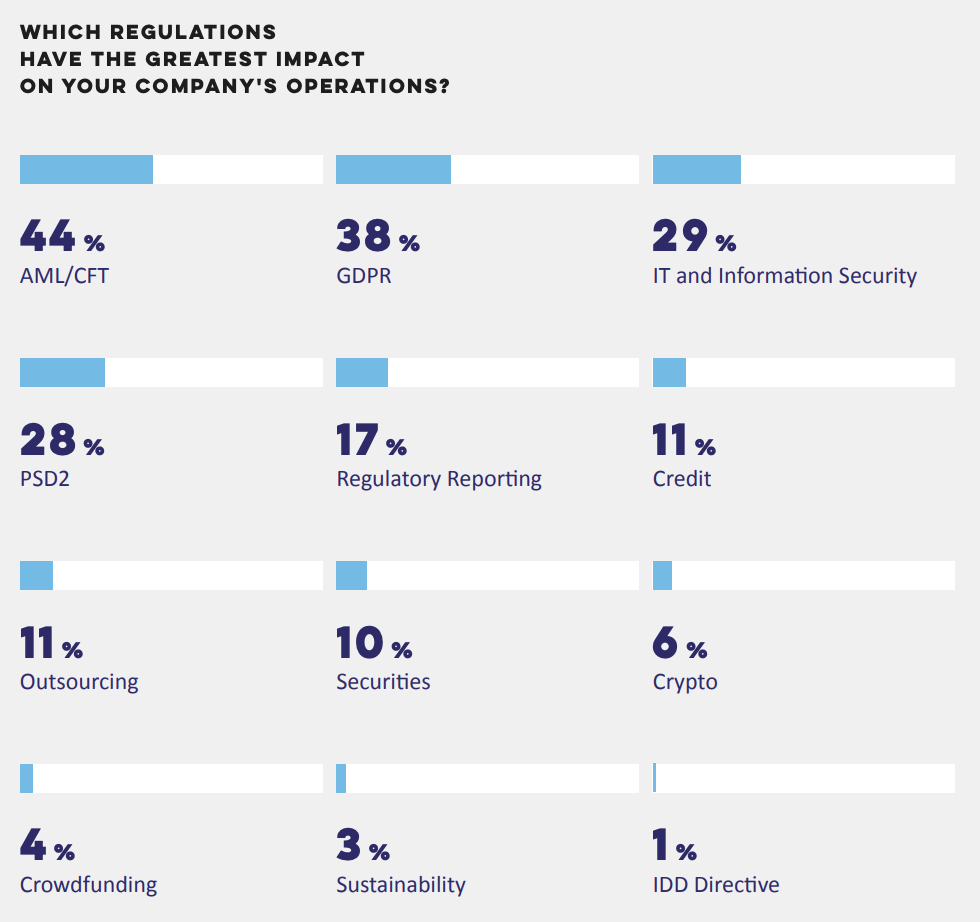

Besides the challenging funding environment, study respondents also shared that they felt increased regulatory burden in 2022 compared to 2021, naming the regulations regarding anti-money laundering and terrorist financing (AML/CFT) (44%), the European Union (EU) General Data Protection Regulation (GDPR) (38%), and IT and Information Security (ICT) (29%) as being among the most burdensome and impactful regulations.

Which regulations have the greatest impact on your company’s operations?, Source: 2023 Fintech Report: From Growth to Profitability, Swedish Fintech Association, 2023

To address increased regulatory complexity, the report suggests that the dialogue between supervisory bodies and the fintech industry should be increased. This would allow the Swedish Financial Supervisory Authority (FSA) to get a deeper understanding of the innovations taking place in the market, the report says.

Regulators should also provide fintech companies with better access to guidance in regard to regulatory compliance as well as during permit processes, and should introduce a regulatory sandbox. Such a regime could increase the degree of innovation in the financial market and improve the understanding of which regulations different fintech companies’ business models should comply with, it says.

The report also advises for the introduction of an open finance regulation to increase competition in the financial market and boost innovation. It further recommends Swedish legislators to look out for the EU’s proposal on instant payment scheme and ensure whether or not the new rules would be applicable for Swedish currency.

EU’s digital payment ambitions

The European Commission put forward a legislative proposal in October 2022 to ensure that citizens holding a bank account in the European Economic Area can make instant payments in euro.

Under the proposed rules, payment service providers offering standard credit transfers in euro are to also offer the service of sending and receiving instant payments in euro. The charges these providers apply for instant payments must not be higher than the charges they apply for standard credit transfers.

The rules aim to make instant payments in euro more affordable, universally available, secure, and processed without hindrance across the EU.

The initiative is part of the bloc’s retail payment strategy, which aims to improve and modernize the region’s payment ecosystem. The strategy focuses on developing a pan-European solution for payments at the point of interaction that is governed at the European level, deploying instant payments across the region, improving cross-border payments beyond the EU, and supporting innovation and digitalisation.

The plan is closely linked to and consistent with the European Central Bank’s current work on a possible digital euro. The central bank digital currency (CBDC) initiative, which started in 2021, focuses on developing a digital version of the bloc’s currency that’s widely accessible, free for basic use and available both online and offline.

The digital euro project will be entering the “preparation phase” in November 2023. The phase, which is expected to last two years, will involve finalizing the digital euro rulebook and selecting providers that could develop the digital currency’s platform and infrastructure. It will also include testing and experimentation with the CBDC.

The Swedish fintech landscape

Despite the challenging fundraising environment and the increasingly complex regulatory landscape, Swedish fintech companies remain bullish on their growth prospects for the year to come.

88% of respondents believe that their business will see increased growth in 2023 and 81% said they will need to expand their workforce this year.

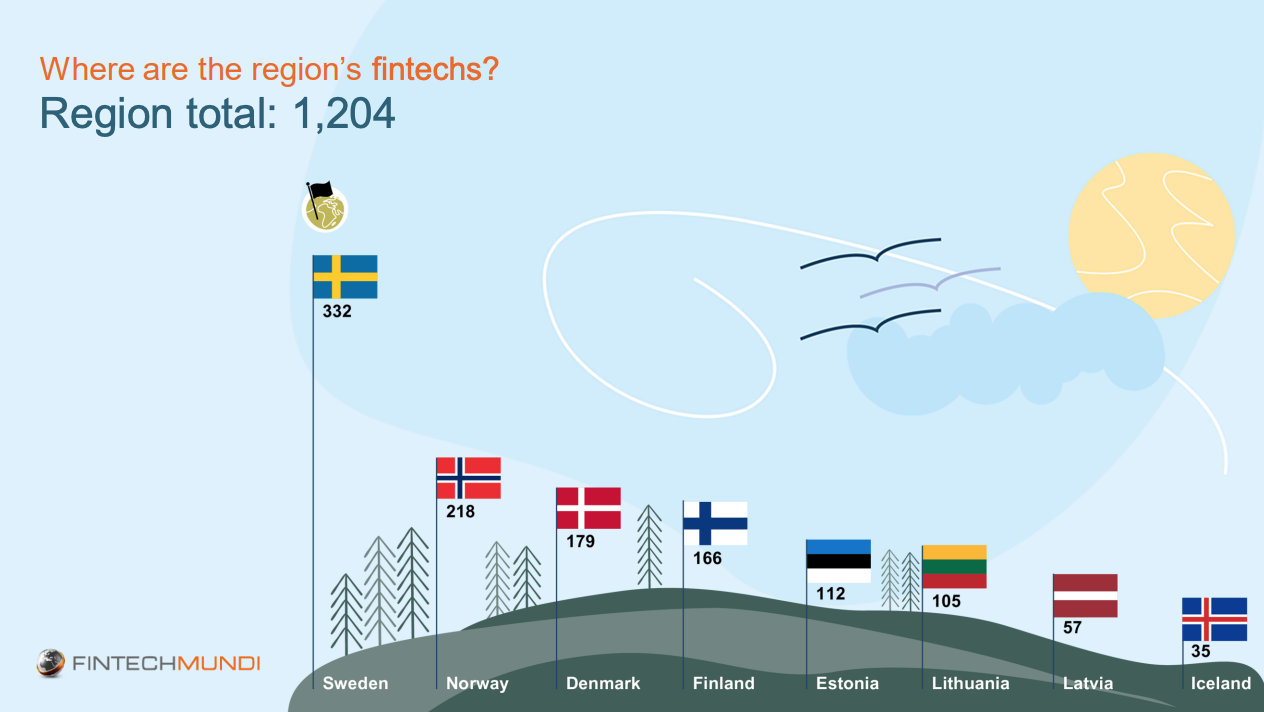

Across the Nordic and Baltic regions, Sweden has the largest and most advanced fintech ecosystem. In 2022, the country was home to 332 fintech companies, representing 27.5% of all fintech startups across the Nordics and Baltics, a report by Fintech Mundi and Mastercard says.

Sweden is also home to some of the world’s biggest and most successful fintech ventures. These startups include Klarna, a buy now pay later specialist headquartered in Stockholm, that’s one of Europe’s biggest fintech startups and which is valued at a reported US$6.7 billion.

Number of fintech companies across Nordic and Baltic nations in 2022, Source: Digitalization’s Next Act: Nordic Fintech 2022, Fintech Mundi, Mastercard, May 2022

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.